Financial institutions live and breathe sensitive information. Account numbers, loan documents, client statements, and compliance reports – and much of it still gets printed, shared, reviewed, and archived on paper. The problem? One unattended print tray or unsecured device can undo years of investment in cybersecurity. That’s why secure printing for finance firms isn’t just a “nice to have” anymore. It is now a part of foundational control. Done right, secure print solutions protect data, simplify compliance, and actually make day-to-day work smoother, not slower.

From Printer to Person: How Secure Print Release Stops Data Exposure

In many offices, documents are printed the moment someone hits “send,” then sit in output trays waiting to be picked up. In a financial environment, that’s a serious risk. Secure print release flips the model. Documents are held in an encrypted queue and only printed when the authorized user is physically present.

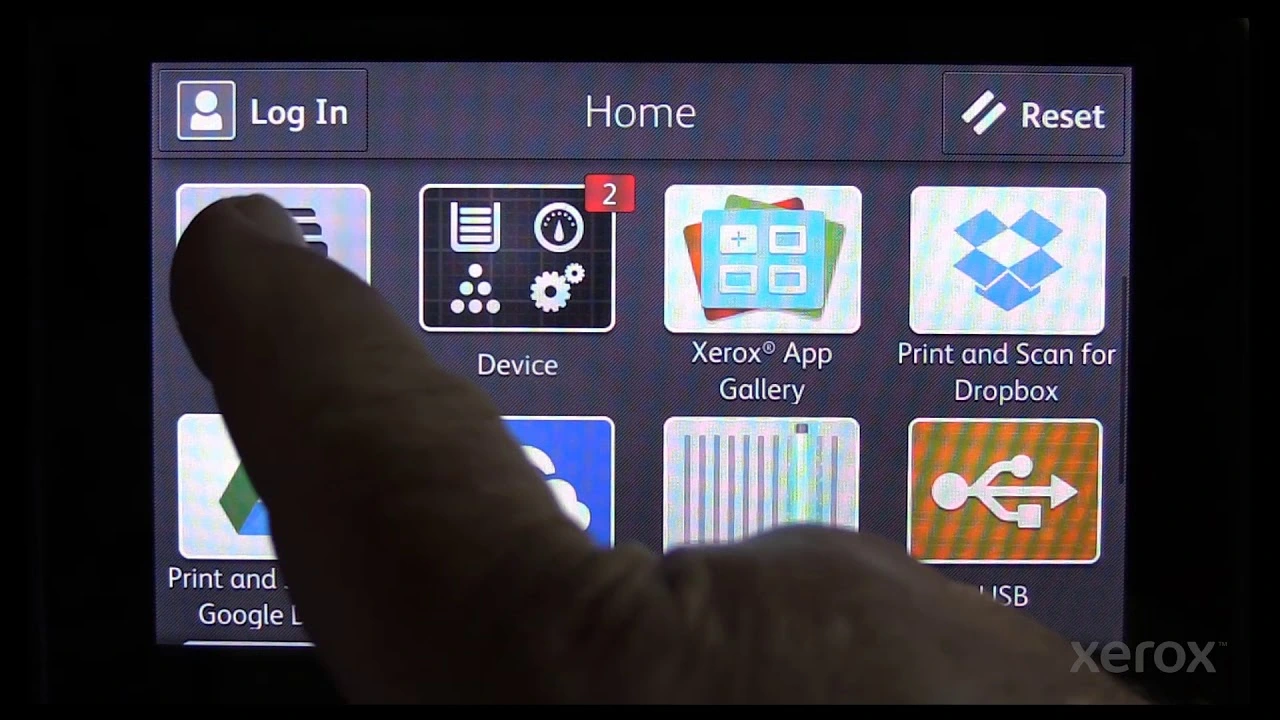

With badge tap, PIN entry, or smart card authentication, sensitive files don’t appear until the right employee is standing at the device. This simple shift eliminates accidental exposure, prevents “shoulder surfing,” and ensures confidential client data never lands in the wrong hands – even in shared office spaces or high-traffic departments.

Encryption in Motion: Protecting Financial Data End to End

Financial data needs as much protection at rest as it needs when it’s moving. Modern secure print solutions encrypt data as it travels from desktops, servers, and cloud platforms to the printer itself. That matters more than ever as finance teams rely on hybrid infrastructure.

Xerox® devices are built with encrypted data transmission and protected storage, reducing the risk of interception or device-level compromise. Whether a report is scanned to a secure folder, printed from a virtual desktop, or routed through a cloud workflow, encryption helps ensure sensitive information stays unreadable to anyone without authorization.

Identity-Driven Printing: Making Access Intentional, Not Accidental

Not everyone in a finance organization should have access to every document, and secure printing enforces that reality. User authentication ties printing privileges directly to employee identity, not just a workstation.

This means:

a. Role-based access to printers and features.

b. Restrictions on color, volume, or document types.

c. Reduced risk from shared logins or generic print queues.

Requiring users to verify who they are before printing or scanning secures printing for finance firms and turns access into a deliberate act, not a default setting.

Audit Trails That Stand Up to Regulators

When auditors ask who printed what, when, and where, “we think” isn’t an acceptable answer. Secure print environments generate detailed audit trails that track document activity across devices and users.

These logs support compliance with financial regulations and internal governance requirements by:

a. Providing traceability for printed and scanned documents.

b. Supporting investigations or internal reviews.

c. Demonstrating control over sensitive information flows.

Instead of scrambling for evidence, finance teams gain reporting that’s ready when regulators come knocking.

Secure Printing Across Branches, Devices, and Cloud Platforms

Today’s finance workforce is rarely tied to a single office. Branch locations, remote teams, and mobile executives all need access to documents, without weakening security.

Secure mobile and cloud printing make that possible. Employees can submit print jobs from approved devices or platforms and release them securely at authorized printers, regardless of location. Centralized policies ensure consistent security standards across branches, while cloud integrations reduce reliance on local servers.

Xerox printer lease for finance organizations ensures scalable security that grows with the business – not a patchwork of one-off fixes.

Policy-Driven Printing That Reduces Errors Before They Happen

Human error is still one of the biggest threats to data security. Automated print policies reduce risk by removing guesswork from everyday tasks.

Smart rules can:

a. Route sensitive documents to approved devices only.

b. Enforce duplex or black-and-white printing where appropriate.

c. Restrict external printing of confidential files.

Embedding policies directly into the print environment helps firms cut down on mistakes while keeping workflows efficient and predictable.

Conclusion: Security That Builds Confidence, Not Friction

Apart from locking things down, secure print solutions also generate confidence. Confidence that client data is protected. Confidence that compliance standards are being met. Confidence that employees can work efficiently without risking exposure.

With the right technology and the right partner, secure printing becomes a quiet safeguard working in the background. Flynn’s helps financial institutions design and support secure print environments using Xerox® technology that balances protection, usability, and cost control.

Ready to protect your print environment without slowing your teams down? Talk to Flynn’s about secure printing for finance firms today.